Va State Income Tax Rate 2025. Make estimated payments online or file form 760es payment voucher 1 by may 1, 2025. Find your state's income tax rate, see how it compares to others and see a list of states with no income tax.

34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes. Updated for 2025 with income tax and social security deductables.

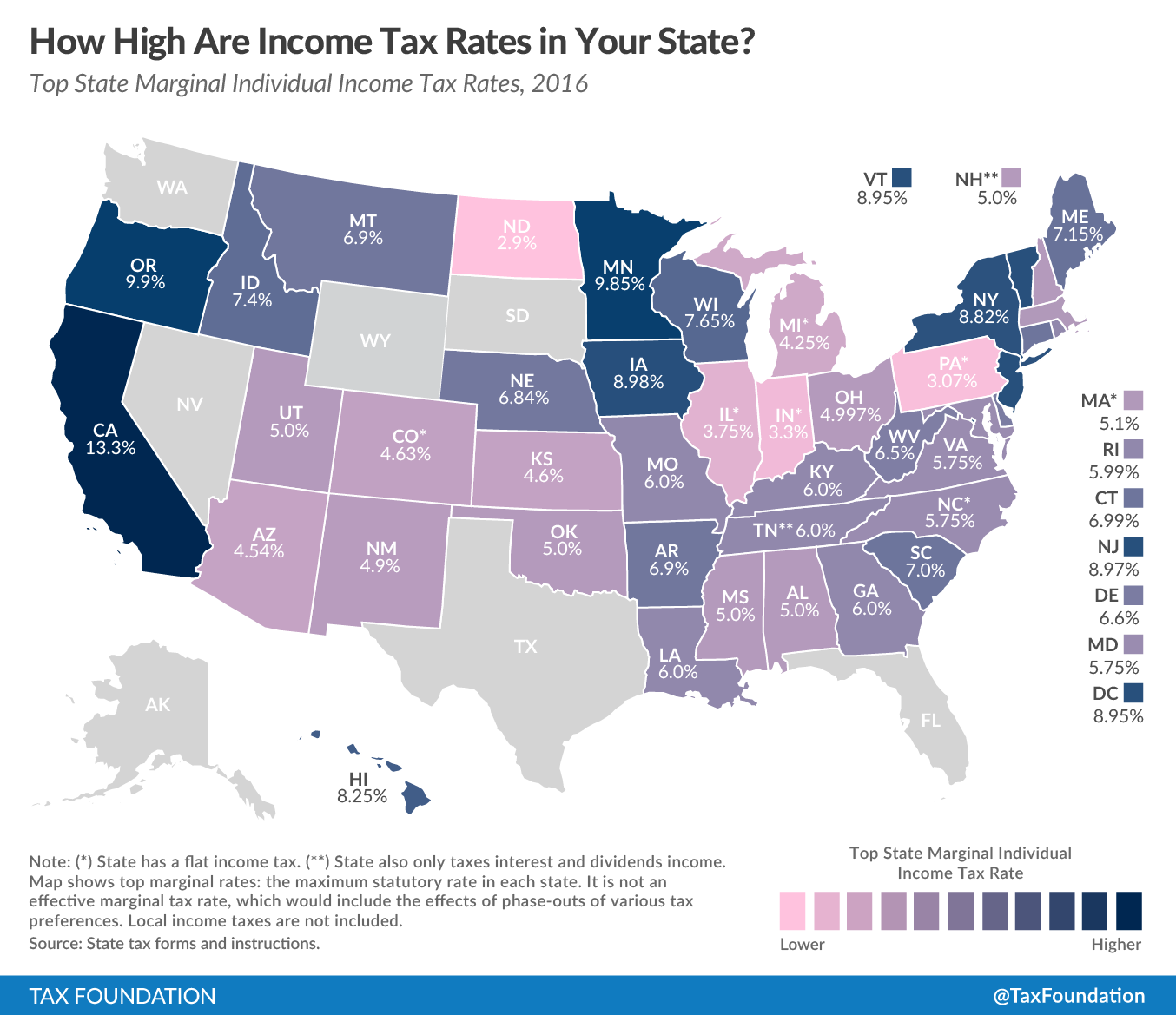

Find your state's income tax rate, see how it compares to others and see a list of states with no income tax.

The median state’s top income tax rate will be 4.95 percent at the start of 2025, so it makes sense for virginia, with a top rate of 5.75 percent, to prioritize rate.

Ranking Of State Tax Rates INCOBEMAN, 16 cents per gallon of regular. The actual average tax rate the top 1% of taxpayers pay is more than three times what biden said:

Tax rates for the 2025 year of assessment Just One Lap, 34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes. Speaker, madam vice president, members of congress, my fellow americans.

Tax Rates 2025 To 2025 2025 Printable Calendar, 16 cents per gallon of regular. The virginia tax calculator includes tax.

How High are Tax Rates in Your State?, 16 cents per gallon of regular. Based on the lowest, average, or highest tax brackets.

Top State Tax Rates for All 50 States Chris Banescu, Estimated income tax payments must be made in full on or before may. Virginia residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

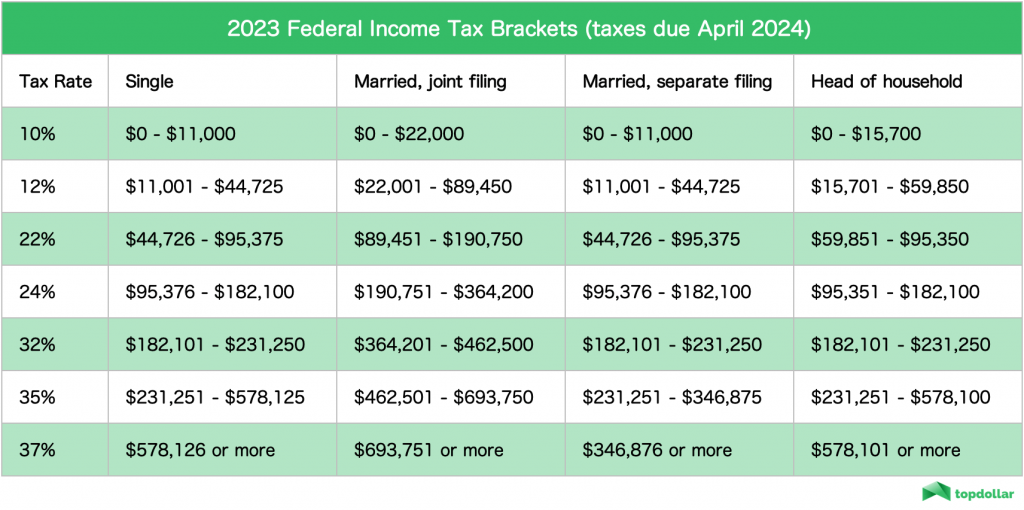

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, Your average tax rate is. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Va Tax Withholding Tables Elcho Table, Tax rate schedule if your virginia taxable income is: Virginia residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

To What Extent Does Your State Rely on Individual Taxes?, Not over $3,000, your tax is 2% of your virginia taxable income. The salary tax calculator for virginia income tax calculations.

U.S. states with the highest and lowest tax rates, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Not over $3,000, your tax is 2% of your virginia taxable income.

Top State Marginal Tax Rates 2025 Skloff Financial Group, Maryland has eight tax brackets, ranging from 2 percent to 5.75 percent. A more elite group, the.

The virginia state tax calculator (vas tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.